Are Mats Expenses In Accounting

This initial cost will be substantial and will include many factors including the rent mortgage insurance and renovations if necessary.

Are mats expenses in accounting. In other words debiting an expense account increases the balance instead of decreasing it like most other equity accounts. An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. Expense accounts are considered contra equity accounts because their balance decreases the overall equity balance. Balance sheet statement of financial position.

Essentially accounts expenses represent the cost of doing business. Net profit a trial balance of the general ledger accounts taken after the temporary owner s equity accounts have been closed is referred to as. An expense in accounting is the money spent or costs incurred by a business in their effort to generate revenues. Expenses are subtracted from revenues to calculate overall equity in the expanded accounting equation and.

Technically expenses are decreases in economic benefits during the accounting period in the form of decreases in assets or increases in liabilities that result in decreases in equity other than those relating to distributions to equity participants. If the total of expenses is smaller than the total of revenues the difference is termed. Uniform system of accounts for restaurants expense dictionary preliminary for review and discussion only transaction description recommended account 401k plan contributions company employee benefits insurance and retirement retirement pension plan expenses. Expenses refer to costs incurred in conducting business.

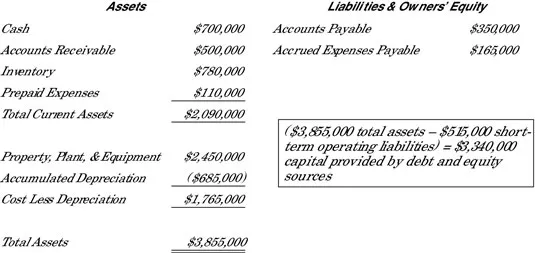

Bad debts expense uncollectible accounts expense loss from uncollectable accounts accounts receivable that are uncollectible. Due to the accrual principle in accounting expenses are recognized when they are incurred not necessarily when they are paid for. Statement of financial condition a formal financial statement illustrating the assets liabilities and owner s equity of a business as of a specific date. They are the sum of all the activities that result in hopefully a profit.

For help scroll down to learn about the many expenses in the laundry business. It is not an expense of the business. Expenses in the laundry business. Typical expenses include utilities employee wages maintenance costs insurance supplies lease payments and personal property taxes.

The amount is due to the supplier and creates a liability recorded under accounts payable. In the example assume the laundromat incurred 100 000 in utilities expenses 75 000 in wages 80 000 in maintenance 25 000 in insurance 40 000 in supplies 30 000 in lease payments and 20 000 in.