Are Floor Cleaning Services Sales Taxable Florida

Florida department of revenue sales and use tax on cleaning services page 1 sales and use tax on cleaning services.

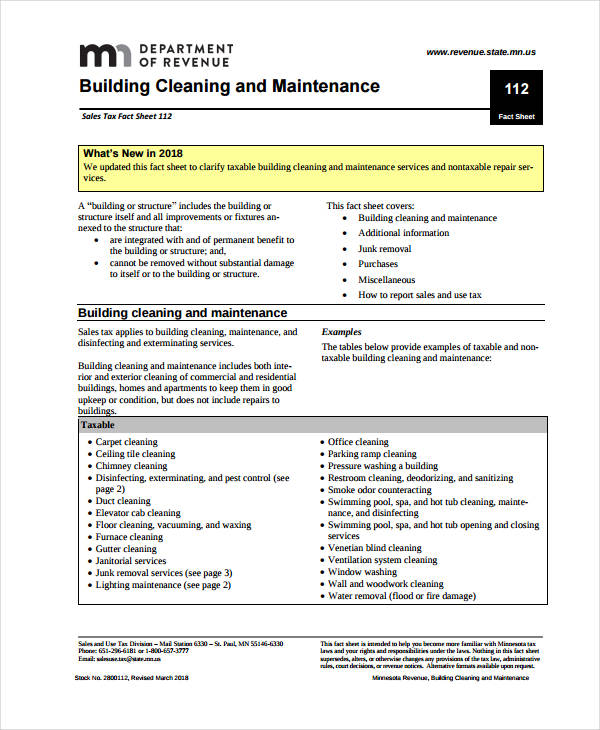

Are floor cleaning services sales taxable florida. So carpet cleaning falls outside the realm of taxable 561720 services and is therefore not subject to florida sales tax. The service of cleaning nonresidential buildings a category that includes public lodging establishments as defined by the north american industry classification system is generally subject to sales tax. Nonresidential cleaning services are subject to state sales tax plus any. What services are taxable.

Information on the taxability of services to residential facilities and nonresidential buildings. Those same cleaning services are taxable to non residential customers. Additionally the materials and supplies purchased by taxpayers to perform those services are taxable at the time of. The same is true of restaurant ventilation hood cleaning services which falls under the non taxable industry standard code 561790 for chimney cleaning services.

The state of florida does not usually collect sales tax from the vast majority of services performed. Certain services are subject to sales tax in florida and certain services are exempt. What the rule neglects to mention is that 501 c 3 s can rent real estate tax exempt under 212 08 6 p.