Apr Floor Cap Arm

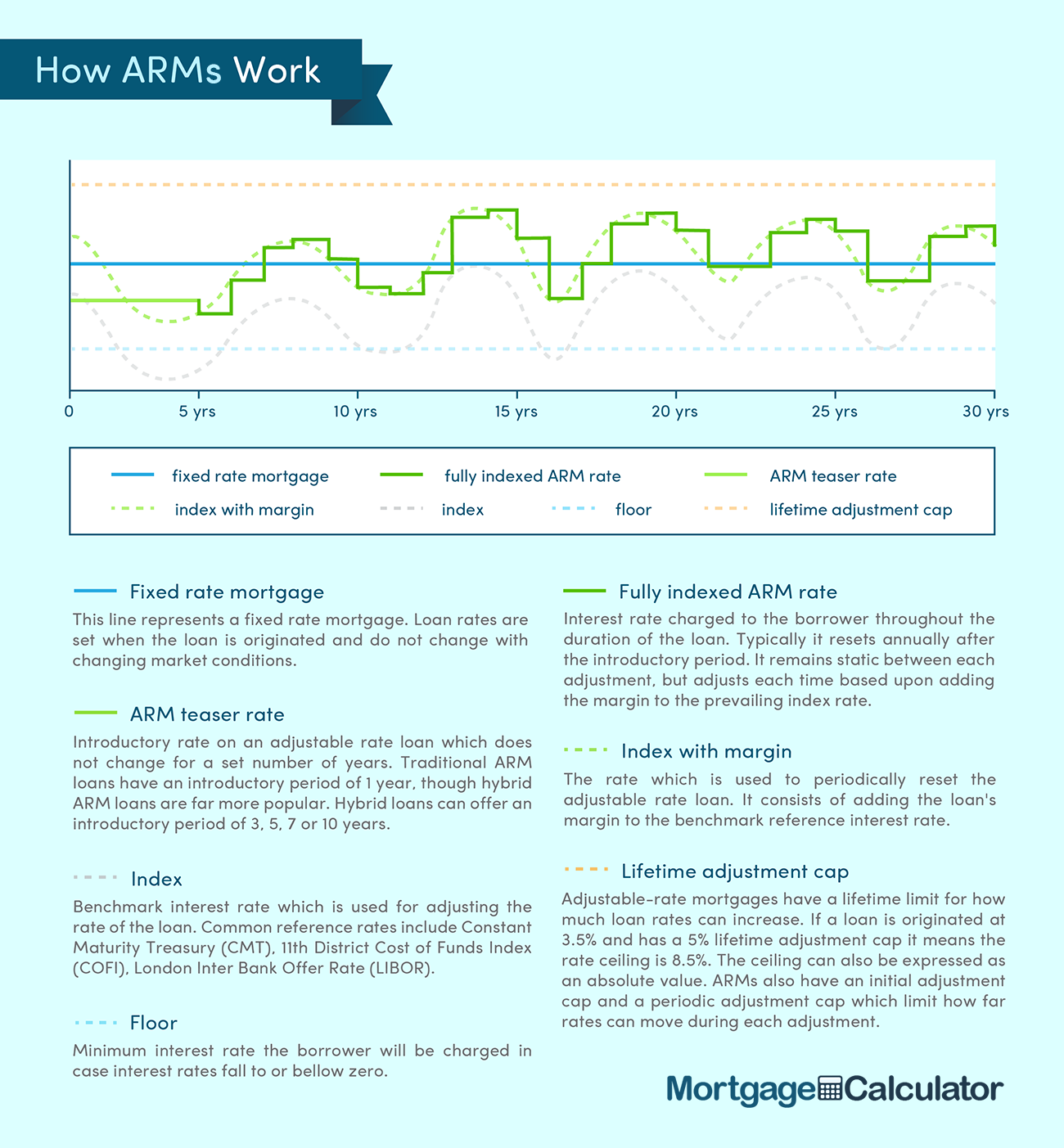

It s common for this cap to be either two or five percent meaning that at the first rate change the new rate can t be more than two or five percentage points higher than the initial rate during the fixed rate period.

Apr floor cap arm. The apr arm calculator an adjustable rate mortgage arm also sometimes referred to as a variable rate mortgage or a tracker mortgage is ideal for those who don t mind sacrificing consistency for fluctuation and possible but not guaranteed savings on your monthly bill. Don t base your mortgage decision solely upon the apr. This cap says how much the interest rate can increase the first time it adjusts after the fixed rate period expires. If your initial interest rate is equal to the index interest rate plus your margin taking into account any rounding your adjustable rate loan is fully indexed with these types of loans you calculate the apr the same way you would with a fixed rate loan.

They are most frequently taken out for periods of between 2 and 5 years although this can vary considerably. This may happen when the payment cap negotiated in the arm is so low that the principal plus interest payment required is greater than the payment cap allows. When calculating aprs on adjustable rate products you must look at your initial interest rates to determine your course of action. There are three kinds of caps.

Apr and arm calculations. If your mortgage has a floor of 2 0 percent your interest rate will never drop below this even if its fully indexed rate is lower. An interest rate cap is a derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price an example of a cap would be an agreement to receive a payment for each month the libor rate exceeds 2 5. Loan limit annual cap life cap floor margin.

This is an agreement with between the lender and the home buyer that allows the buyer to convert the arm to a fixed rate mortgage at specific times during the life of the mortgage. The lifetime cap is usually expressed as a percentage. Adjustable rate mortgage apr. An apr refers to the mortgage s interest rate as well as the mortgage broker fees points and any additional charges you may pay.

The maximum interest rate on an adjustable rate mortgage arm that may be charged at any point over the life of the mortgage. Interest rate floors are utilized in derivative.